U.S. equity markets are trading higher at the start the macro week following news of an Apple (AAPL) and Google (GOOG/GOOGL) partnership for AI on the iPhone.

Also, 2-year T-Note, Silver, Crude Oil, and Japanese Yen Futures

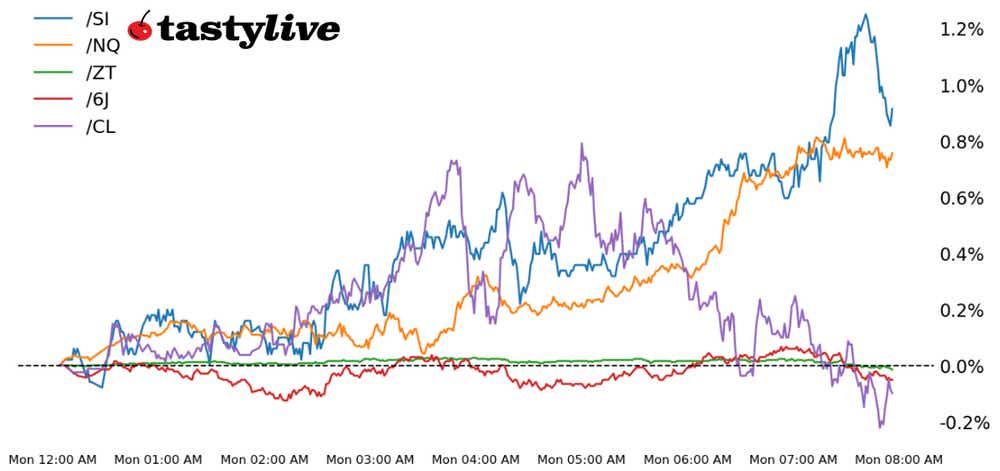

Nasdaq 100 E-mini futures (/NQ): +1.30%

2-year T-Note futures (/ZT): -0.01%

Silver futures (/SI): +0.33%

Crude Oil futures (/CL): +1.01%

Japanese Yen futures (/6J): -0.13%

U.S. equity markets are trading higher at the start of a dense macro week following news of an Apple (AAPL) and Google (GOOG/GOOGL) partnership for AI on the iPhone.

A quartet of central bank meetings this week (BOJ, RBA, Fed, and BOE) has traders concerned that policymakers will be relatively hawkish, pushing up global bond yields – including U.S. Treasury yields – on Monday.

Elsewhere, precious metals remain in positive territory though have been fading gains, while energy prices are up across the board as Russia has had to shutter refineries in recent days amid a flurry of Ukraine drone strikes.

Symbol: Equities | Daily Change |

/ESM4 | +0.80% |

/NQM4 | +1.30% |

/RTYM4 | +0.35% |

/YMM4 | +0.19% |

Nasdaq futures (/NQM4) inched higher Monday to start the week after traders digested news from Apple and Google. The iPhone maker is said to be in talks with Google to build its Gemini artificial intelligence engine into the iPhone, according to Bloomberg news.

Nvidia (NVDA) is up nearly 3% ahead of the open as the hype around the news boosts AI prospects.

Strategy: (43DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 17000 p Short 17250 p Short 19250 c Long 19500 c | 60% | +1450 | -3550 |

Short Strangle | Short 17250 p Short 19250 c | 68% | +4845 | x |

Short Put Vertical | Long 17000 p Short 17250 p | 84% | +665 | -4335 |

Symbol: Bonds | Daily Change |

/ZTM4 | -0.01% |

/ZFM4 | -0.07% |

/ZNM4 | -0.11% |

/ZBM4 | -0.29% |

/UBM4 | -0.47% |

The rate-sensitive short end of the Treasury curve is little changed Monday morning, with 2-year T-Note futures (/ZTM4) down 0.01%. Bonds traders are anxiously awaiting Wednesday’s announcement from the Federal Reserve, which will come alongside updated economic and inflation projections.

However, the last couple weeks of action in the bond market have priced in the chances that rates will stay higher than previously expected in 2024. The Treasury will auction 3- and 6-month bills today.

Strategy (39DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 101.375 p Short 101.5 p Short 102.75 c Long 102.875 c | 48% | +78.13 | -171.88 |

Short Strangle | Short 101.5 p Short 102.75 c | 55% | +328.13 | x |

Short Put Vertical | Long 101.375 p Short 101.5 p | 94% | +46.88 | -203.13 |

Symbol: Metals | Daily Change |

/GCJ4 | +0.02% |

/SIK4 | +0.33% |

/HGK4 | +0.47% |

Silver traders are positioned for rate cuts and the chance that they may not come as soon as expected isn’t phasing precious metals traders. The view that rate cuts are eventually coming, coupled with strong economic growth, is bidding silver prices (/SIK4) higher, with prices up 0.33% this morning. The Fed’s Wednesday morning will be key to the metal’s direction.

Strategy (38DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 24 p Short 24.25 p Short 26.5 c Long 26.75 c | 43% | +595 | -655 |

Short Strangle | Short 24.25 p Short 26.5 c | 59% | +3490 | x |

Short Put Vertical | Long 24 p Short 24.25 p | 73% | +315 | -935 |

Symbol: Energy | Daily Change |

/CLJ4 | +1.01% |

/HOJ4 | +1.98% |

/NGJ4 | +5.14% |

/RBJ4 | +1.51% |

Crude oil prices (/CLJ4) rose 1.01% to start the week after Ukrainian attacks on Russian oil refiners spooked the energy markets. Several Russian refiners, over the weekend, were attacked with drones, causing fires at the Slavyanksy and Syzran oil refineries.

Reuters puts the overall refining capacity in Russia to have fallen by 7% in the first quarter due to attacks.

Elsewhere, OPEC member Iraq stated that it would cut its exports over the short term to comply with quotas.

Strategy (30DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 79 p Short 79.5 p Short 82.5 c Long 83 c | 22% | +380 | -120 |

Short Strangle | Short 79.5 p Short 82.5 c | 55% | +3,630 | X |

Short Put Vertical | Long 79 p Short 79.5 p | 60% | +200 | -300 |

Symbol: FX | Daily Change |

/6AM4 | +0.07% |

/6BM4 | -0.05% |

/6CM4 | +0.05% |

/6EM4 | 0% |

/6JM4 | -0.13% |

Tomorrow may see the end of Japan’s ultra loose monetary policy setting after wage data boosted the chances that the Bank of Japan (BoJ) will hike its benchmark interest rate.

However, if the BoJ holds steady, it would likely cause the yen to fall, as traders have largely priced in the first hike. If that turns out to be the case and we get a volatile reaction, the BoJ would likely clarify its outlook to steady the FX market.

That said, it would be odd to not get a hike given the lack of communication to traders and the lack of pushback against market rate hike odds.

Strategy (46DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 0.0067 p Short 0.00675 p Short 0.00685 c Long 0.0069 c | 30% | +425 | -200 |

Short Strangle | Short 0.00675 p Short 0.00685 c | 54% | +1,375 | x |

Short Put Vertical | Long 0.0067 p Short 0.00675 p | 70% | +237.50 | -387.50 |

Christopher Vecchio, CFA, tastylive’s head of futures and forex, has been trading for nearly 20 years. He has consulted with multinational firms on FX hedging and lectured at Duke Law School on FX derivatives. Vecchio searches for high-convexity opportunities at the crossroads of macroeconomics and global politics. He hosts Futures Power Hour Monday-Friday and Let Me Explain on Tuesdays, and co-hosts Overtime, Monday-Thursday. @cvecchiofx

Thomas Westwater, a tastylive financial writer and analyst, has eight years of markets and trading experience. @fxwestwater

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Source link

Nasdaq 100, S&P 500 Open Higher After Apple-Google News #Nasdaq #Open #Higher #AppleGoogle #News

Source link Google News

Source Link: https://www.tastylive.com/news-insights/nasdaq-100-s-p-500-open-higher-after-apple-google-news